qyld compare|QYLD vs XYLD: Which is the Better Buy? : Clark Compare Global X NASDAQ 100 Covered Call ETF QYLD and Global X S&P 500® Covered Call ETF XYLD. Get comparison charts for tons of financial metrics! WEBHello! 👋 B2Chater. Welcome! Please enter your data. Username. Password.

0 · XYLD vs. QYLD ETF Comparison Analysis

1 · QYLD – Global X NASDAQ 100 Covered Call ETF

2 · QYLD vs. XYLD: Head

3 · QYLD vs. XYLD — ETF comparison tool

4 · QYLD vs XYLD: Which is the Better Buy?

5 · QYLD vs XYLD, DIVO, RYLD: Which is the Better Buy?

6 · QQQ vs. QYLD — ETF comparison tool

7 · Nasdaq 100 Covered Call ETF (QYLD)

8 · Global X Covered Call ETF (QYLD) Vs RYLD Vs

9 · 9

WEB561.2k 99% 6min - 1080p. Explicita Video. Gordelicia que nada. a ninfeta é uma puta gostosa. Anal total com a novinha. 1.9M 100% 10min - 720p. Nerd da bunda grande .

qyld compare*******QYLD vs. XYLD comparisons: including fees, performance, dividend yield, holdings and technical indicators to make a better investment decision. Check out the side-by-side . Compare QYLD and XYLD based on historical performance, risk, expense ratio, dividends, Sharpe ratio, and other vital indicators to decide which may better fit .Compare QQQ and QYLD based on historical performance, risk, expense ratio, dividends, Sharpe ratio, and other vital indicators to decide which may better fit your portfolio.

Compare Global X NASDAQ 100 Covered Call ETF QYLD and Global X S&P 500® Covered Call ETF XYLD. Get comparison charts for tons of financial metrics!

May 31, 2024

Compare ETFs XYLD and QYLD on performance, AUM, flows, holdings, costs and ESG ratings.

May 31, 2024 Compare Global X NASDAQ 100 Covered Call ETF QYLD, Global X S&P 500® Covered Call ETF XYLD, Amplify CWP Enhanced Dividend Income ETF DIVO . The trailing 12-month yield for JEPQ was 8.83%, compared to QYLD’s 11.73%. However, JEPQ has a lower expense ratio at 0.35%, significantly lower than QYLD’s . 2021 has come to an end and I compare QYLD against the other Global X Covered Call funds RYLD and XYLD. Check out which ETF wins in this comparison. A daily TR performance chart comparing QYLD to QQQ starting 2/19/2020 is quite interesting. 1) The max drawdown to the COVID bottom for QQQ was about 3.75% more -- makes sense given that .

Compare Global X NASDAQ 100 Covered Call ETF QYLD and JPMorgan Nasdaq Equity Premium Income ETF JEPQ. . QYLD, JEPQ Peers' Key Metrics # Name Total Assets Expense Ratio YTD Total Rtn TTM Total Rtn 5Y Total Rtn 10Y Total Rtn ; 1: Global X NASDAQ 100 Cover.. (QYLD) $8.246B:The chart below shows a comparison of QYLD and JAPEX’s performance since 2019. As you can see, both funds have reported a healthy total gain: 7.5% CAGR for QYLD and 11.3% for JAPEX. Steven Fiorillo & Global X. On 1/4/21, RYLD traded at $22.37 per share so an initial investment of 100 shares would have cost $2,237. In 2021, RYLD generated $3.01 per share in annual .

qyld compare QYLD vs XYLD: Which is the Better Buy? I compare RYLD to XYLD and QYLD versus different periods, including 2021 - present and 2022 YTD. See whether RYLD ETF is a better investment or not here.JEPQ vs. QYLD: Head-To-Head ETF Comparison. The table below compares many ETF metrics between JEPQ and QYLD. Compare fees, performance, dividend yield, holdings, technical indicators, and many other metrics to make a . Click for our QYLD update. . Compare to Peers. More on QYLD. Nasdaq 100 Covered Call ETF declares monthly distribution of $0.1686. Why 11.7%-Yielding QYLD Is A Poor Passive Income MachineFind the latest Global X NASDAQ 100 Covered Call ETF (QYLD) stock quote, history, news and other vital information to help you with your stock trading and investing. QYLD is an ETF that aims to provide income and capital appreciation by writing covered call options on the NASDAQ 100 index. Learn more about QYLD's performance, holdings, fees, and ratings from .

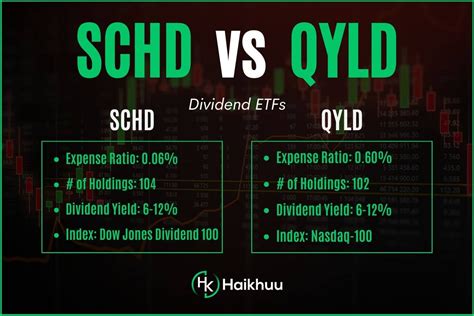

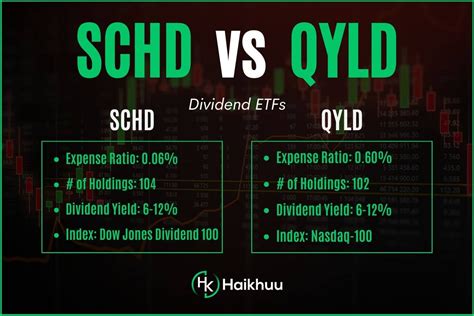

About QYLD. The Global X NASDAQ 100 Covered Call ETF (QYLD) is an exchange-traded fund that is based on the Cboe NASDAQ-100 BuyWrite V2 index. The fund tracks an index that holds Nasdaq 100 stocks and sells call options on those stocks to collect the premiums. QYLD was launched on Dec 12, 2013 and is issued by Global X.qyld compare The trailing 12-month yield for JEPQ was 8.83%, compared to QYLD’s 11.73%. However, JEPQ has a lower expense ratio at 0.35%, significantly lower than QYLD’s 0.61%. One advantage for QYLD is .

QYLD: Comparing 2 Nasdaq 100 High Yield Funds. Aug. 25, 2020 9:54 AM ET Nuveen NASDAQ 100 Dynamic Overwrite Fund (QQQX), QYLD 37 Comments 32 Likes. Dave Dierking, CFA. 5.92K .At its intraday 7/19/22 price of $18.02, QYLD had the highest dividend yield of the group, at 12.05%. It should go ex-dividend next on ~8/22/22. It has a five-year average dividend growth rate of .

QYLD writes calls on the NASDAQ 100 and pays outsized distribution yields. . 9.24% for XYLD to 12.73% for QYLD. Compare them to the entire universe of CEF covered-call funds I opened this .

QYLG is tiny in comparison, with just $106.5M in assets. QYLD and QYLG have a 0.60% expense ratio; QQQX's expense ratio is higher, at .92%. None of these three funds use leverage.

QYLD vs XYLD: Which is the Better Buy? QYLG is tiny in comparison, with just $106.5M in assets. QYLD and QYLG have a 0.60% expense ratio; QQQX's expense ratio is higher, at .92%. None of these three funds use leverage.The ETF Database Realtime Ratings allow advisors and investors to objectively compare ETFs based on ratings of six key metrics as well as an Overall Rating. QYLD vs. QYLD comparisons: including fees, performance, dividend yield, holdings and technical indicators to make a better investment decision.

You compare the performance of QYLD to QQQ since the year 2013. Of course, covered calls will underperform in that time frame, it was one of the best bull markets in history. So it just doesn’t seem a fair comparison, that kind of bull run can’t be sustainable in the long term.

Summary. I look at QYLG and QYLD from 2021 forward and in 2022 alone to see how they compare to each other. QYLG and QYLD both utilize a buy-write strategy on the Nasdaq 100 but QYLG only writes .

1 de set. de 2015 · Metal Gear Solid V: The Phantom Pain is a singleplayer first-person and third-person stealth game developed by Kojima Productions and published by .

qyld compare|QYLD vs XYLD: Which is the Better Buy?